Services

What I Do & My Process

Hourly Rate: $450 per hour

Comprehensive Financial Planning: Hours vary based on complexity, starting at $2,400.

Financial Advice for Specific Issues: Billed based on actual time worked

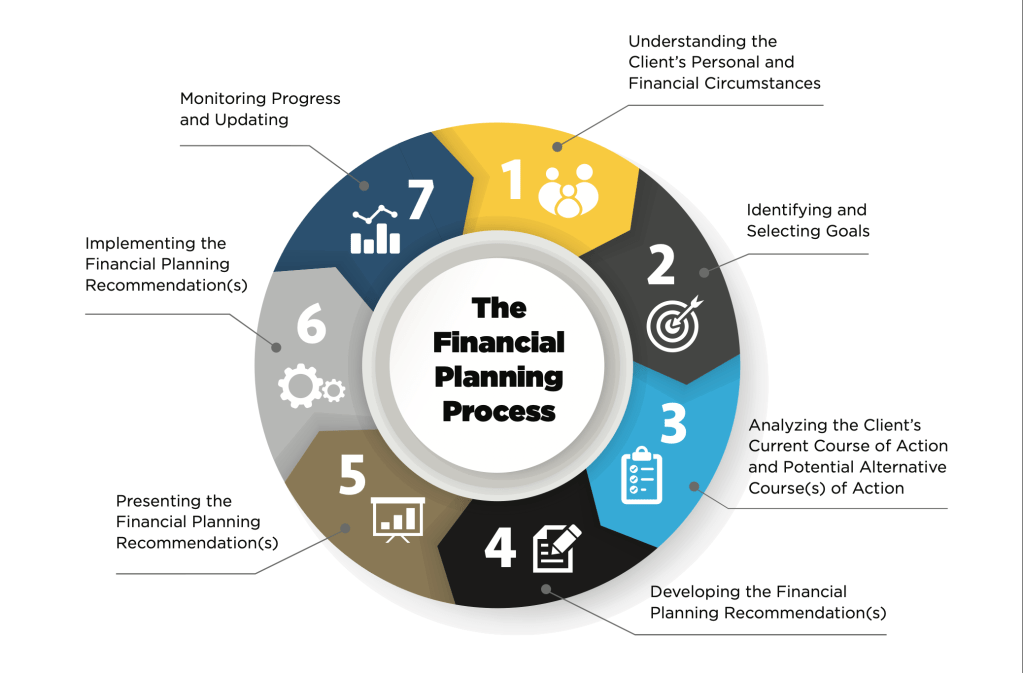

The Financial Planning Process at MeasuredMint follows the CFP Board’s 7-step process, ensuring a structured, objective approach to helping clients make informed financial decisions.

For clients seeking comprehensive financial planning, I integrate all relevant aspects of your financial life, including cash flow, investments, taxes, risk management, and equity compensation.

For clients seeking financial advice on specific issues, I provide guidance on an as-needed basis—but only when the advice does not require full financial planning under CFP Board’s Practice Standards.

The 7 Steps of Financial Planning

1. Understanding Your Situation

The first step is gathering relevant details about your financial position, including:

Income, cash flow, and expenses

Investments, retirement savings, and benefits

Tax situation and estate planning considerations

Stock plan documents (if applicable)

2. Setting Your Goals

Together, we define your short-term and long-term financial objectives, which may include:

Retirement planning and financial independence

Managing stock-based compensation and liquidity events

Tax minimization and risk management

Funding major life goals (education, home purchase, etc.)

3. Analyzing Your Financial Strengths and Vulnerabilities

I evaluate the strengths and risks in your financial situation, considering:

Investment allocation and risk exposure

Cash flow sustainability and savings strategy

Tax implications of financial decisions

Equity compensation risks (concentration, diversification, tax impact)

4. Developing Financial Planning Recommendations

Based on my analysis, I develop customized strategies to help you achieve financial security and optimize decision-making.

5. Planner Presents Recommendations

I walk you through my recommendations, explaining:

The rationale behind each strategy

The financial trade-offs and tax implications

Actionable steps for implementation

6. Putting Your Financial Plan Into Action

While I do not execute transactions, I assist in:

Choosing between available financial products

Coordinating with your tax and legal advisors

Ensuring all aspects of your plan align with your goals

7. Monitor Performance: Expect a Collaborative Partnership

Comprehensive financial planning is not a one-time event—it requires ongoing adjustments as your circumstances change. While I do not provide ongoing asset management, I encourage periodic reviews when:

New equity awards are granted

Major life events occur (career changes, liquidity events, retirement)

Tax laws change

Source: The Financial Planning Process. © 2025 CFP Board. All rights reserved. Reprinted with permission.

Compliance with CFP Board Standards

Certain financial decisions—especially those related to equity compensation, tax strategies, or investment risk—may require comprehensive financial planning rather than isolated advice.

If your situation requires integration across multiple financial areas, I will:

✅ Explain why financial planning is necessary and the benefits of a broader approach.

✅ Clarify any limitations if you choose not to engage in financial planning.

✅ Clearly define the scope of services to ensure regulatory compliance.

Source: Integration Factors. © 2019 CFP Board. All rights reserved. Reproduced with permission.